company tax computation format malaysia 2017

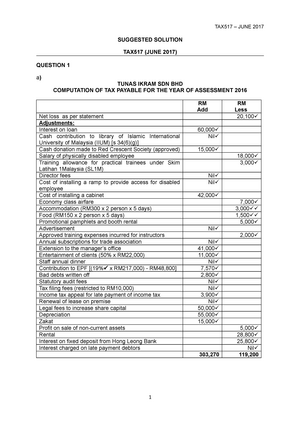

FSPPP - UiTM AM225 Company tax computation format. Tax under the Labuan Business Activity Tax Act 1990 instead of the Income Tax Act 1967 ITA.

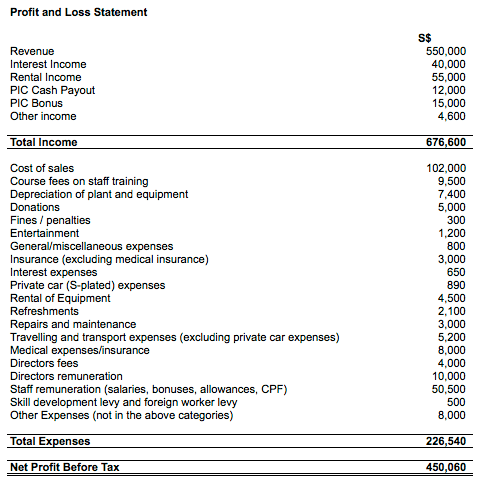

Analyzing A Bank S Financial Statements

On Business BE 2017 EXPLANATORY NOTES.

. Calculates income tax based on variable monthly remuneration. Use for multiple tax years. A SME is defined as a company resident in Malaysia which has a paid-up capital of ordinary shares of RM25.

On the chargeable income exceeding RM600000. Wagner Kirkman Blaine Klomparens Youmans LLP. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai.

Tax computation for Encik Ahmad for year assessment 2017 Joint. While the 28 tax rate for non-residents is a 3 increase from the previous years 25. Any Loan Taken Or Repaid 20000 In Cash.

Illegal Exp Booked In P L. The below reliefs are what you need to subtract from your income to determine your. TAX COMPUTATION YEAR OF ASSESSMENT 2015 MALAYSIA wwwhasilgovmy LEMBAGA HASIL DALAM NE-GERI MALAYSIA LHDNMR0816 INDIVIDUAL TAX COMPUTATION Under the Self-Assessment System an individual is required to compute his own tax EXAMPLE.

No guide to income tax will be complete without a list of tax reliefs. Malaysia is subject to withholding tax under s 109A. The volume of imports from Malaysia has.

Income tax rates. Share free summaries past exams lecture notes solutions and more. Company tax computation format 1.

We also have a plagiarism detection system where all our papers are scanned before being delivered to clients. For the item Income Tax No enter SG or OG followed by the income tax number in the box. Last reviewed - 13 June 2022.

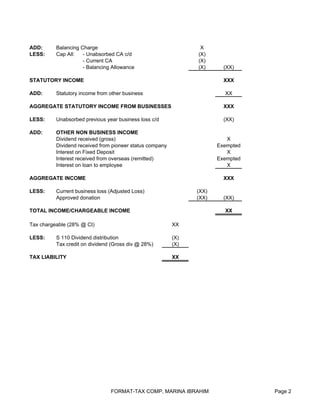

Rate On the first RM600000 chargeable income. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates. On subsequent chargeable income 24.

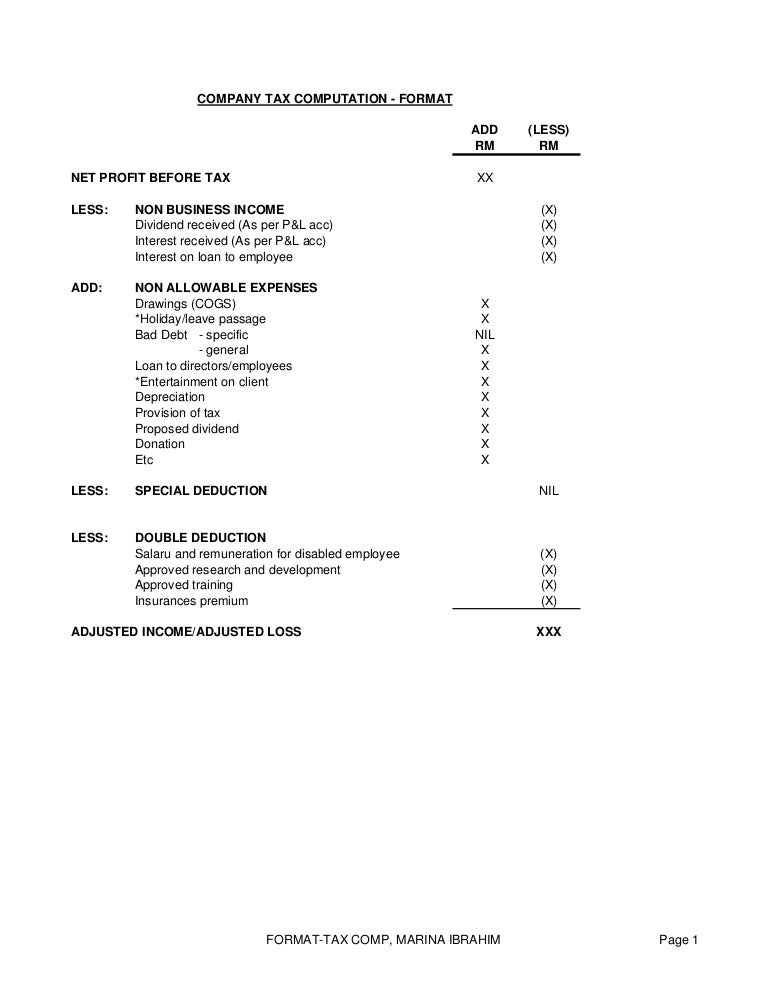

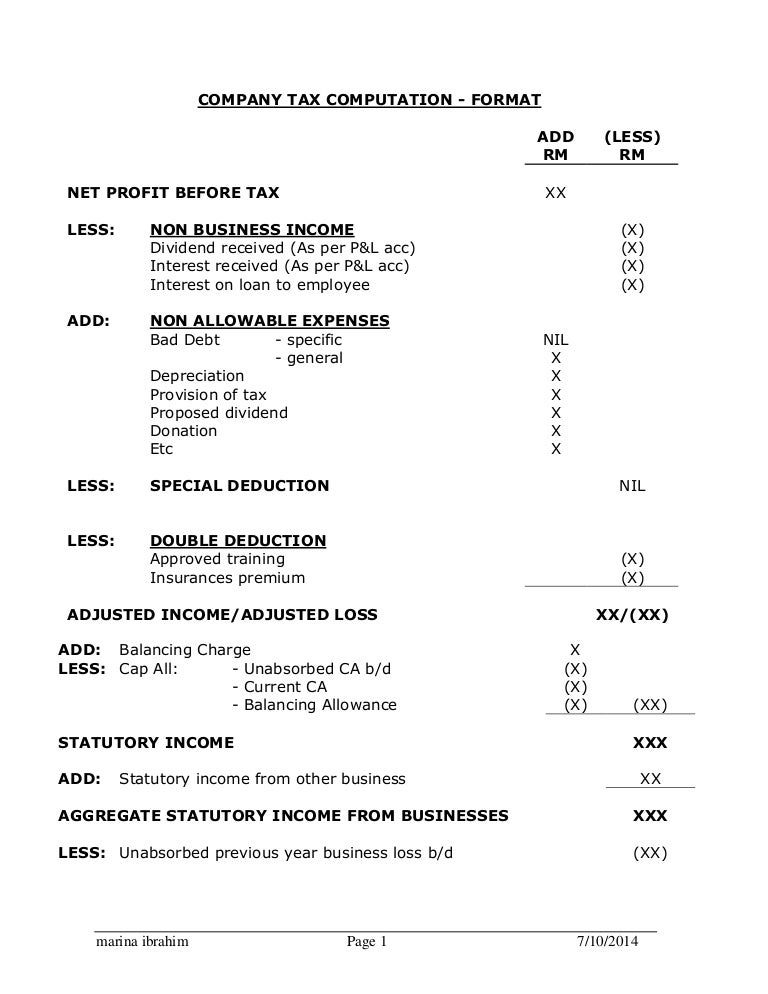

COMPANY TAX COMPUTATION - FORMAT ADD LESS RM RM NET PROFIT BEFORE TAX XX LESS. Includes medical tax credits UIF pension deductions. Following the Budget 2020 announcement in October 2019 the reduced rate.

Income TaxWealth taxInt On TaxPenalty On Tax Shown As ExpDeferred Tax. 50706 Kuala Lumpur Malaysia Tel. Tax Strategies Under the New Section 199A.

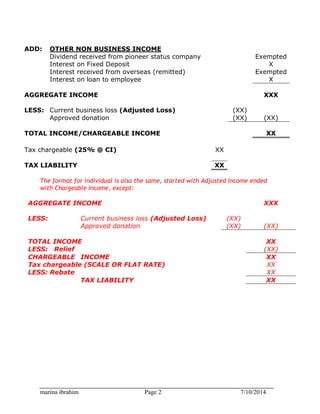

All income tax calculations are automated. Non-resident company branch 24. NON BUSINESS INCOME X Dividend received As per PL acc X Interest received As per PL acc X Interest on loan to employee X ADD.

NON ALLOWABLE EXPENSES Drawings COGS X Holidayleave passage X Bad Debt. His income for 2015. View Tax computation for Encik Ahmad for year assessment 2017docx from HIST 336 at Wellesley College.

1 TAX SEPTEMBER 2017 SUGGESTED SOLUTION SET1 SOLUTION 1 MM Manufacturing Sdn Bhd Tax computation for the year of assessment 2017 Add Ded - Note RM000 RM000 RM000 Business income. The corporate tax rate has decreased from 40 in the late 1980s to the current rate of 24. Commencing with the profit before tax compute the chargeable income of Uni Sdn Bhd for the year of assessment 2014.

But in Malaysia its a bit different. Regulation in network and service sectors 2018. A True B False C True only for companies D True only for individuals and non-corporates 6 Lee is a Canadian employed by a Malaysian company.

5 Under the self-assessment system an assessment is deemed to have been made by the Director General of Inland Revenue on the date the tax return is submitted The above statement is. Paid-up capital up to RM25 million or less. Sources outside Malaysia - 1 - c PU.

1 - 4 Fill in relevant information only. Calculate monthly net salary tax on annual bonus. Not only has the corporate tax rate been decreased over the years the government has also given SMEs a special rate of 17 on the first RM500000 chargeable income for YA 2019.

Net revenue is the total amount left with the company after making vital deductions of different kinds of expenses. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. You should indicate by the use of the word nil any item referred to in the question for which no adjusting entry needs to be made in the tax computation.

Following table will give you an idea about corporate tax computation in Malaysia. Technical or management service fees are only liable to tax if the services are rendered in Malaysia. Gov revenue formsandresources forms.

2017 2017 ADDITIONS AMENDMENTS. On first RM500000 chargeable income 17. 33 taxable income and rates.

Following table will give you an idea about company tax computation in Malaysia. Any Cash Payment 20000 Of Any Expense Per Day. Easy to update tax rates other variables for new tax years.

Lee arrived in Malaysia on 1 June 2010 and. Taxation Answer Format. Headquarters of Inland Revenue Board Of Malaysia.

SINGLE INDIVIDUAL Mr Azman works in ABC Sdn Bhd. The current CIT rates are provided in the following table. Corporate - Taxes on corporate income.

Chargeable income MYR CIT rate for year of assessment 20212022. A Labuan entity can make an irrevocable election to be. Calculation of Corporate Tax in Malaysia Company tax is computed on the net revenue of a company or SME.

Section 43 B Expenses Interest On Bank LoanBonusPf Not Paid Till Return Filing Date 30 Sept. 30 marks 7 PTO. A 1512012 on The Returning Expert Programme at the Official Portal of Lembaga Hasil.

Resident company with paid-up capital above RM25 million at the beginning of the basis period 24. This might seem impossible but with our highly skilled professional writers all your custom essays book reviews research papers and other custom tasks you order with us will be of high quality. PwC 20162017 Malaysian Tax Booklet Tax YA 2016.

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

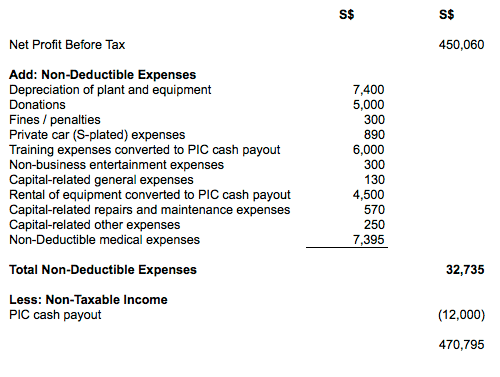

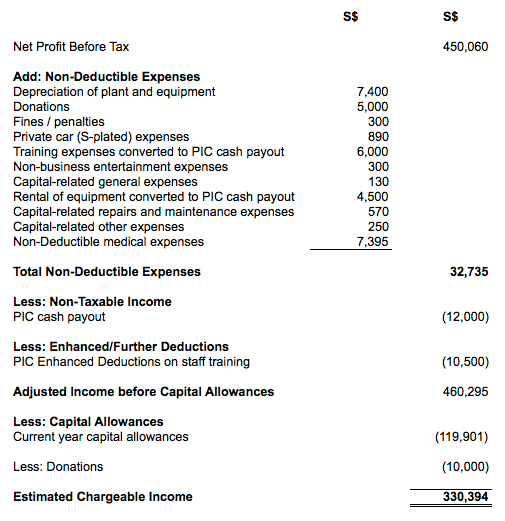

Company Tax Computation Format

Company Tax Computation Format

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

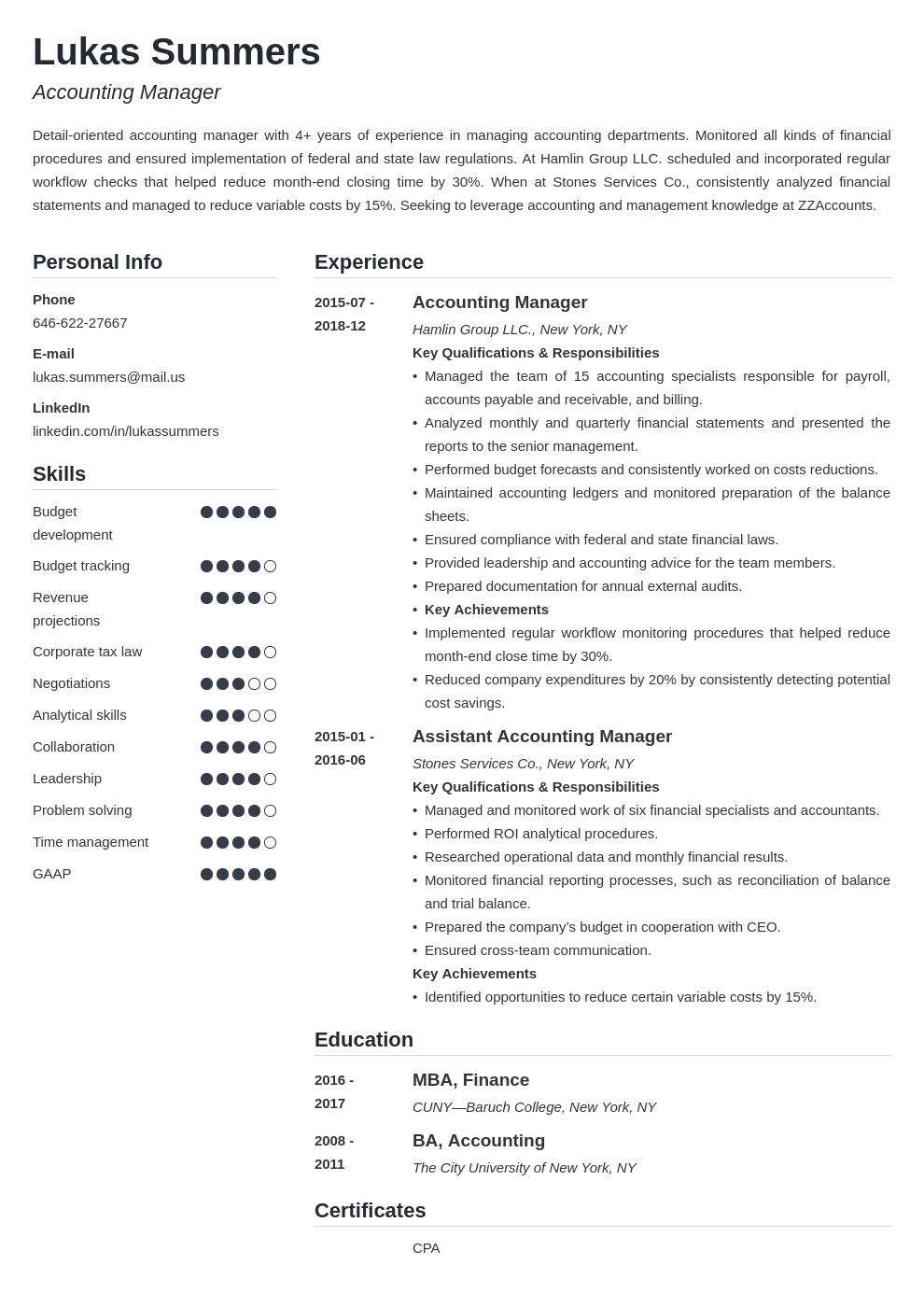

Accounting Assistant Resume Sample Job Description Tips

Tax Computation Format For Company In Malaysia Fill Online Printable Fillable Blank Pdffiller

Company Tax Computation Format 1

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

Format For The Computation Of Business Income Tax 267 Business Income Format Format For The Studocu

Solution Tax517 Jul 2017 Suggested Solution Tax517 June 2017 Question 1 A Tunas Ikram Sdn Studocu

Real Property Gains Tax 101 Malaysian Taxation 101

Company Tax Computation Format 1

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

Company Tax Computation Format 1

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

No comments for "company tax computation format malaysia 2017"

Post a Comment